- #RENTAL AND ROYALTY INCOME AND EXPENSES WORKSHEET 2015 HOW TO#

- #RENTAL AND ROYALTY INCOME AND EXPENSES WORKSHEET 2015 FULL#

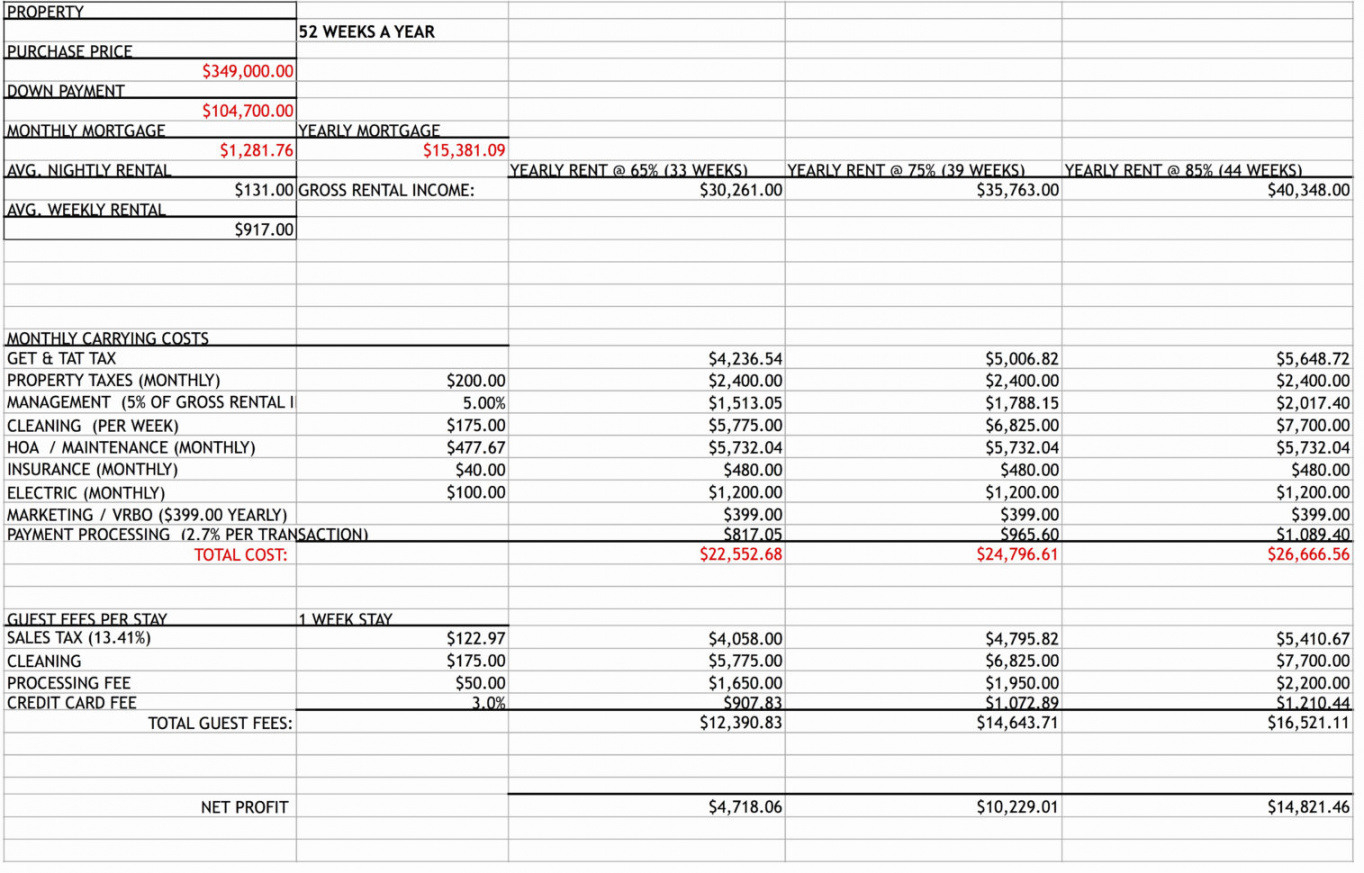

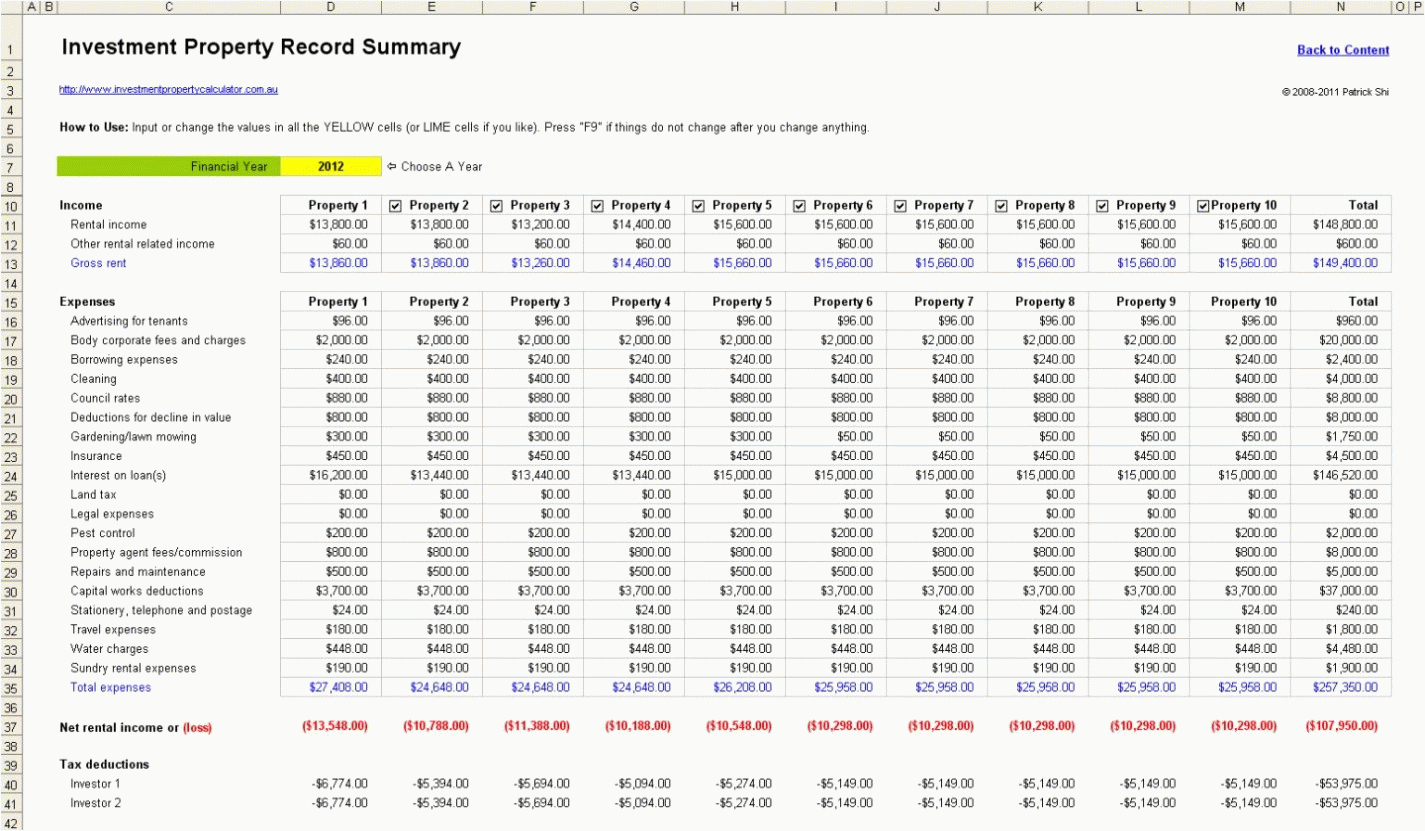

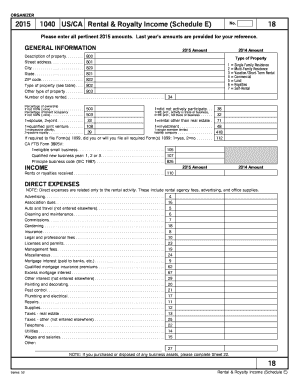

There are several reasons why keeping accurate records for a rental property makes good business sense.įirst, accurately keeping records for a rental property lets you know if you are really making a profit, and helps you strategize on ways to maximize profits.

#RENTAL AND ROYALTY INCOME AND EXPENSES WORKSHEET 2015 HOW TO#

How to Keep Accurate Rental Property Records

#RENTAL AND ROYALTY INCOME AND EXPENSES WORKSHEET 2015 FULL#

If the cost of a home is $150,000 (not counting the lot) the annual full year depreciation would be $5,455 ($150,000 / 27.5 years).įor example, if the annual pre-tax income from a property is $5,000 and the depreciation expense taken is $5,455, the property would have a negative income of $455 for tax purposes even though there is positive cash flow of $5,000. The IRS allows residential rental property to be depreciated over a period of 27.5 years, excluding the land or lot because land does not wear out. There’s no monthly rental income coming in, but operating expenses and the mortgage must still be paid.ĭepreciation expenses can also create a loss by reducing taxable net income. Negative net income can occur when a vacant property is first purchased and the landlord is looking for a tenant.

Instead, a rental security deposit is recorded as a liability on the property balance sheet. Security deposits are not treated as rental income if they are meant to be refunded to the tenant.

In this article, we’ll take an in-depth look at the rental income and expense worksheet, including a quick and easy way to accurately track the financial performance of rental property to help maximize potential profits. Real estate investors use a rental income and expense worksheet to accurately track cash flow each and every month, calculate return on investment or “ROI,” identify opportunities to increase revenues, and make sure they are claiming every tax deduction the IRS allows. There’s an old saying that goes, “You can’t really know where you are going until you know where you have been.” That’s true in life, and especially true when you’re investing in real estate.

0 kommentar(er)

0 kommentar(er)